THE CHALLENGES

RMs and directors (RM supervisors) are entrusted with the dual responsibility of getting new customers and catering to the needs of the existing ones. Here are some of the poorly addressed questions that they encounter while going about their tasks:

- How much time should I invest in managing and converting leads versus retaining and growing existing customer relationships?

- How can I ensure the alignment of my activities with organizational goals?

- Which prospects are likely to convert and provide better customer lifetime value?

- What are the behavioral patterns of the various customers being served by the organization?

- What are the org-level best practices that will enable me to deliver a consistent and effective experience to my customer?

- Which customers are likely to churn? What should I do to prevent the churn and when?

Most organizations are at a loss of addressing these questions, even when they try to address some of these the methods often don’t yield desired ROI. Adoption of the solution, practices and tools is another challenge organizations often encounter for a workforce that is more on the road and is well known for heroics rather than for their process, systematic approach and adoption of yet another system.

APPROACH THAT OFFERS A BETTER ROI

As the movie Moneyball has demonstrated, better and faster conversions and higher lifetime value of customers cannot rely solely on high-performing RMs. Organizations need to enable all their RMs—including the star performers—to improve their performance through actionable insights. These insights can be mined from existing organizational data using technology that can help with analysis, planning, and monitoring, thus reducing manual efforts significantly and enabling the RMs to make informed decisions.

Consumer behavior has several patterns which may not be easily discernible. The combinations and permutations of these patterns can be overwhelming for humans to process and manage consistently. And due to the ever changing business demands, RMs need to see beyond the obvious—risks, opportunities, and their causes and symptoms that are hiding in data across systems.

This is where machine intelligence comes in. Systems based on machine intelligence and predictive analytics are great at observing, processing, predicting, reminding and following up clinically and consistently on such threats and opportunities. Let machine intelligence and predictive analytics handle this part of analysis while the heroes can focus on their core job responsibilities on the field.

Embracing intelligent systems that can provide such actionable insights empowers the entire RM workforce, irrespective of their experience levels and areas of expertise. They get better tools to learn and cater to the needs of both their employers and customers.

KEY TRAITS OF SYSTEMS THAT DELIVER A HIGH ROI

Most analytics and machine intelligence systems fail in delivering a good ROI because they fall short of addressing one or more of the following aspects effectively. These aspects are extremely crucial in determining the adoption, sustenance, and completeness of the analytics, machine intelligence or decision support systems:

Transference between entities:

Decisions and insights have far reaching impacts beyond the context of where they are found and executed. Similarly, the sources of influence and symptoms may reside beyond a single system or department. Entities—whether they are customers, employees or products—always have transference between them and analyzing them only from one view or a single data source often yields inaccurate or unusable results. Hence, a system should evaluate data from all possible systems holistically. Insights may reveal themselves after connecting the dots between various systems related to Customer Relationship Management (CRM), wealth management, HR, and core banking.

Pane of actionable insights:

The RMs may already be using a system of records for their day-to-day needs; mostly, it is the CRM. If they are asked to adopt a new system to get actionable insights delivered through another pane (application), the outcome is likely to be a failure. The system should be capable of delivering and integrating into their existing framework of execution.

Data generation and quality woes:

The common challenges while implementing data science initiatives are the perception of not having enough data, and, like the chicken-and-egg situation, deciding what to prioritize first—data generation or using data for decision making. Many enterprises encounter non-compliance by employees in updating data in the systems and the subsequent challenge of the quality of information that is provided as an output. The system should be capable of working with incomplete, and to a certain degree, poor quality of data. It should also have mechanisms in place to monitor and encourage data compliance for the data owners/sources.

Changing reality:

The industry keeps changing rapidly and for a growing enterprise, the goals and focus evolve continually. Adoption of an effective system further enhances the direction of the org strategy. It is extremely important that the analytics system is able to see these dynamics both from the data, and at the same time, provide you the control to align your changing goals with the insights and recommended actions. And while all this is happening, it is important for the system to learn and realign focus as per the demands of the business.

Transference between decision areas:

RMs have multiple decision areas that have to be balanced well to yield results aligned to organizational goals. It is important that the analytics system provides actionable insights and recommendations on multiple decision areas that may possibly conflict or may be competing for the same resources (in this case, time). The system should provide a single, consolidated prescription on org-aligned actions and decision areas.CONTEMPORARY INFORMATION SYSTEMS

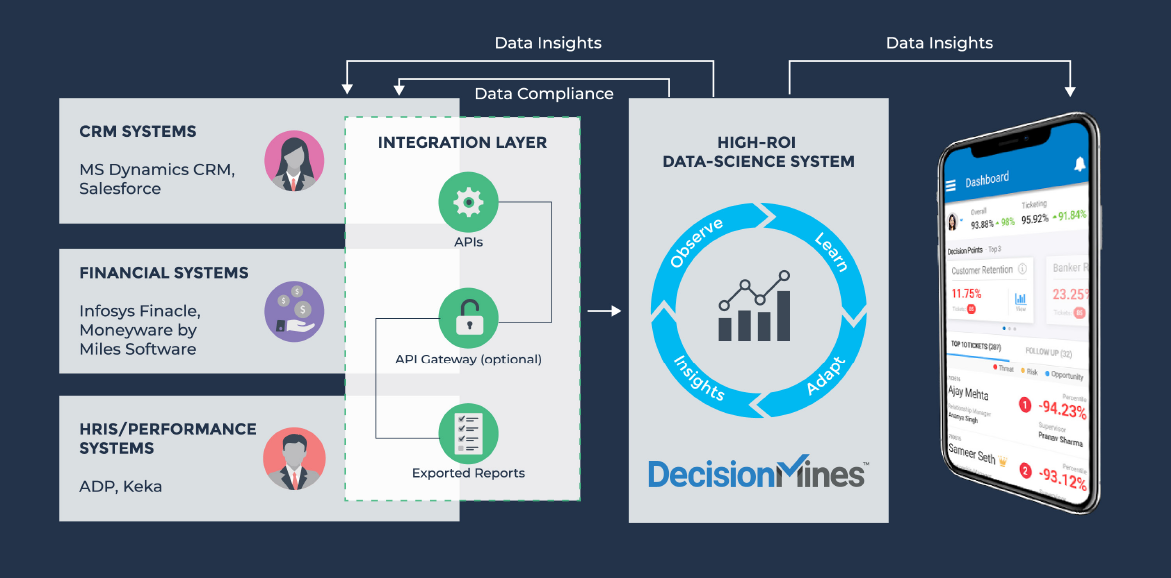

Wealth management firms have traditionally relied heavily on CRM systems to empower RMs with information about customers and prospects. Studies have shown that customer trust and loyalty appreciate when a firm is able to successfully implement Customer Knowledge Management (Bhat et al, 2018). Over the years, CRM systems have evolved to integrate with other sources of customer information; however, CRM systems alone fall short of delivering actionable insights to RMs due to the nature of the information itself. The IT landscape in a wealth management firm typically involves many more information systems and to obtain a holistic view for analysis and machine intelligence, the following three categories of systems (at a minimum) must be considered for inputs:

CRM systems:

Widely adopted across the industry. A multitude of financial systems also possess CRM capabilities. Popular CRMs adopted in the industry include Microsoft Dynamics and Salesforce.

Financial transaction systems:

These systems form the execution backbone of wealth management with capabilities such as trade execution, portfolio management, financial planning, and proposals. These can also include Enterprise Resource Planning (ERP) systems. Popular products adopted by Indian firms include Infosys Finacle and MoneyWare by Miles Software.

HR information systems/performance systems:

These systems help organizations track the performance of individual RMs, supervisors, and sales agents. A few financial systems also provide performance and incentive management capabilities. Popularly adopted systems in the Indian context include ADP and Keka.Coalescing information from disparate systems is a familiar problem for the wealth management industry. The past decade has seen CIOs and IT managers investing heavily to aggregate capabilities and relegate legacy systems. In line with this trend, information systems have provided integration capabilities to allow for a free flow of information with a lot of solution providers offering integration services as well. The aforementioned systems share a symbiotic relationship and must be able to exchange information with each other; financial systems need to interact with external B2B systems, CRM systems need inputs from HR and financial systems, and HR systems need inputs from CRMs and financial systems to track performance. This has resulted in all modern products offering an array of integration capabilities. The most common choice is Application Programming Interfaces (APIs) in the form of Web Services or REST APIs. Other methods include data reporting automation capabilities that can export and import data for other systems to consume. This sets the stage very well for machine intelligence frameworks because they can rely on existing integration capabilities to train complex models to provide critical insights to RMs and supervisors within their existing System of Record (SoR).

With information flowing freely between multiple systems and machine intelligence solutions accessing data from various departments, data security must be taken into consideration to meet an organization’s legal obligations for privacy such as the IT Act of India, 2000. Various compliance solutions and standards have been adopted by the industry and depending on the type of information involved, most solutions comply with certification standards such as ISO 27001 and PCI DSS. A secure machine intelligence framework should support existing certification and audit standards (for example: SOC 1, 2). Security audits should also be conducted regularly to ensure general application security standards such as OWASP, Transport Level Security and Encryption are in line with the organization’s policies.

CONCLUSION

Machine intelligence, as a technology, has assumed a critical and differentiating importance not just for wealth management enterprises, but for all businesses seeking to stay ahead of the competition. Wealth management enterprises should leverage machine intelligence to empower their key on-field workforce to deliver better numbers, and most importantly, better customer experience.

While the market boasts of many products offering machine intelligence and predictive analytics, it is important to look for traits that make up a high-ROI system in the short as well as long term—holistic 360-degree insights, easy accessibility to information on existing applications, and ability to work around data challenges and improve the state of data.