Prescriptive Wealth Management Solutions

Tom Bell

| Relationship Manager RM-CSAT | Conversion Ratio

RM-CSAT | Conversion Ratio

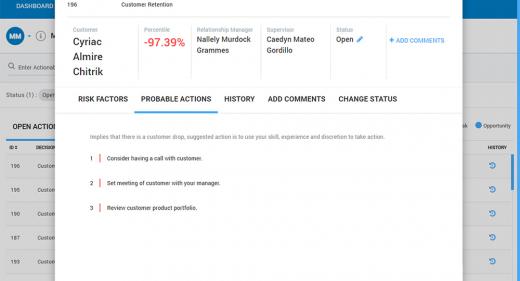

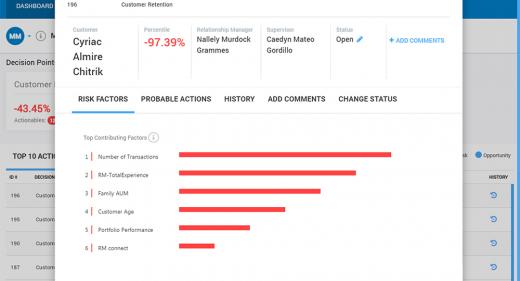

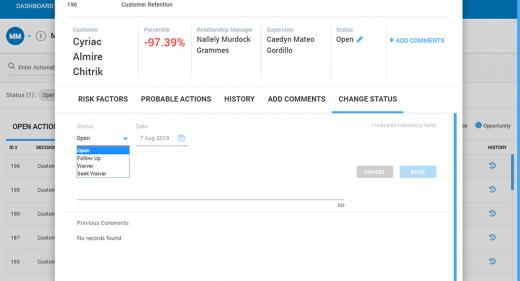

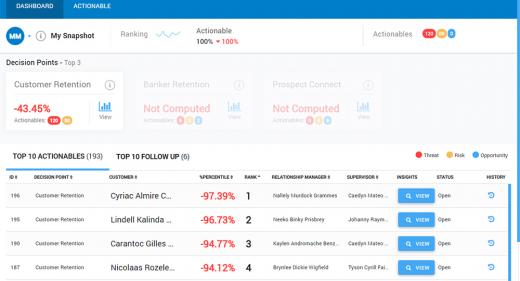

Customer Retention

Actionable insights to focus on customers that are the most likely to drop, along with the probable reasons

Customer retention is as important to profitability as growth and margins. But several unknowns in the ecosystem can catch financial advisors off guard. Data science, combined with their judgment, can help them uncover these blind spots. This means interacting with customers for cross-sell and upsell opportunities without bothering them—facilitated by easy access to historical customer data stored in transactional systems. DecisionMinesTM leverages machine learning, providing predictive financial services for efficient customer relationship management.

Connect with us to know more about how predictive analytics can provide deep insights to minimize customer attrition.

Prospect Connect

Insightful pointers on ‘the most likely to convert’ prospects, enabling quicker and efficient conversions

Wealth management firms need to deliver personalized services to meet customer demands whilst demonstrating their unique selling points, and tackling regulatory burdens and intense competition. For this, relationship managers need deep data insights that unfold in real time as prospect meetings take place. DecisionMinesTM enables you to effectively predict, personalize, and address the data, and formulate effective asset management strategies. It also provides intelligent analysis of historical customer behavior facilitating quicker conversions.

It’s not about the sale, it’s about the solution.

Connect with us to understand how expedites prospect conversion.

Hannah Van

| Director ROAE (Return on Average Equity) | Net Interest Margin

ROAE (Return on Average Equity) | Net Interest Margin

RM Retention

Actionable insights to focus on RMs that are the most likely to attrite,to contain 'bad attrition'

When relationship managers leave an organization, so do some of their biggest customers. The key priority for wealth management firms is to employ RMs and ensure they stay on board by providing them access to a strong wealth management platform with broad product and strong service offerings. Our advanced predictive financial services solution, DecisionMinesTM , provides timely alerts about the early signs of RM attrition and insights into the possible reasons.

Connect with us to discover how predictive analytics for banking & financial services boosts customer service, RM retention, and profitability.

RM Mapping

Assignment of the right RM to the right customer to enhance customer experience and accelerate growth

With the advent of Digital Transformation, customers have become more aware of their needs and hence more demanding. They prefer to interact with a relationship manager on their own terms, rather than the interaction being set up by a firm. This makes the precise mapping of the RM to the customer more crucial than ever before. The effective asset management analytics provided by DecisionMinesTM can help firms understand the customer journey and effectively allocate the right RM to the right customer.

Connect with us to learn more about how DecisionMinesTM streamlines the RM-Customer relationship mapping process.