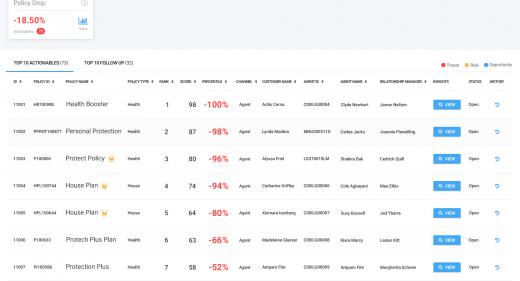

Prescriptive Risk Management Solutions

Steve Mark

| CRO Revenue per Policy Holder | Loss Ratio | Claim Ratio

Revenue per Policy Holder | Loss Ratio | Claim Ratio

Claim Prediction

Policy Pricing

Jane Marty

| Claims Average Cost per Claim | Average Time per Claim

Average Cost per Claim | Average Time per Claim

Cost Optimization

Training Effectiveness

Ben Park

| Sales Sales Target | Strike Rate

Sales Target | Strike Rate

Prospect Tracking